What About Our School?

The new tax referendum, which excludes charter schools, will be voted on in the upcoming November 6th ballot.

November 1, 2018

All students must be treated equally, but what about our school? The upcoming ballot will have a very disturbing referendum: Referendum to Approve Ad Valorem Levy for School Safety, Teacher’s and Operational Needs. If passed, it will exclude public charter schools (i.e. Somerset Academy Canyons). This means that the money the school board raises from additional taxation will not be divided between all public schools – rather, only traditional public schools – leaving public charter schools to raise the money for safety and teachers’ pay on their own, even though charter schools are public schools and legally must be treated the same as other public schools.

“If it is passed, charter schools will not receive any of the benefits [of] the home owners tax increase,” said one Somerset teacher.

What is a tax referendum?

A tax referendum, according to Merriam-Webster Dictionary, is “the principle or practice of submitting to popular vote a measure passed on or proposed by a legislative body or by popular initiative.” This means that you, the voter (or perhaps your parent or guardian, if you cannot vote yet), has the ability to help our school by further examining the tax referendum and what will happen to the tax money when it is in the hands of the school board.

The tax will exclude charter schools

This tax, if voted for, will give any money raised to traditional public schools only, thus excluding public charter schools.

The Referendum to Approve Ad Valorem Levy for School Safety, Teacher’s and Operational Needs reads, “Shall the School Board of Palm Beach County have authority to levy 1.00 mills of ad valorem millage dedicated for operational needs of non-charter District schools to fund school safety equipment, hire additional school police and mental health professionals, fund arts, music, physical education, career and choice program teachers, and improve teacher pay beginning July 1, 2019 and automatically ending June 30, 2023, with oversight by the independent committee of citizens and experts?”

The section to focus on is, “for operational needs of non-charter District schools…” meaning if voted for, the referendum will not be given to public charter schools.

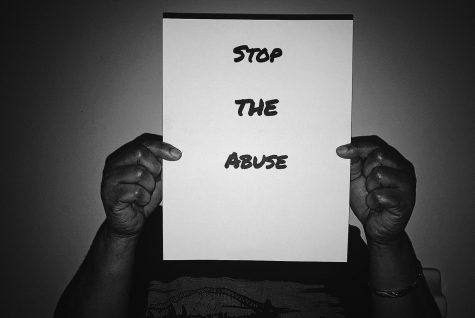

Discrimination?

The tax referendum, if voted for, will be given to schools to use to improve school security and teachers’ salaries. However, are not all students’ safety and all teachers’ wages equally important? Not if it is a charter school, apparently, since Somerset and similar schools will not be receiving a piece of it. The reason for the exclusion of the charter schools is because few, for one, know Florida charter schools are public. Many parents, teachers, and PBC School Board members also believe charter schools are a threat to the traditional school system. In addition to so called “competing,” many Palm Beach county citizens feel that by including the charter schools in the tax, this will cause there to be less money for traditional public schools.

The fallacy of the examples for why many feel the charter schools should not get their cut of the funds is that public charter schools are just as much “public” as traditional public schools. Both types are government-funded locations for young learners, and are open to all students.

Linda Terranova, principal of Western Academy charter in Royal Palm Beach, stated “[PBC School Board Members] are knowingly discriminating against charter school students just because they are attending a school of choice…”

Is it even legal?

The short answer is no.

According to Florida Statutes Title XLVIII Section 1002.33(1) “All charter schools in Florida are public schools and shall be part of the state’s program of public education.”

The Florida statutes clearly state that charter schools are included in public education as long as they are not private.

“Charter schools will not get any of the money, taxes will go up, and my children’s schools will not receive any increase in funding because they go to Charter Schools,” stated Wayne Brown, managing partner of WAB Law PLC and Somerset parent. “Florida constitution provides that all public schools should share in the revenue. That money should follow the student”.

What will be the effects if this is passed?

Though the Referendum to Approve Ad Valorem Levy for School Safety, Teacher’s and Operational Needs will be a huge benefit to traditional public schools, it is going to disadvantage charter schools. The tax, if implemented, will help traditional public schools for many much needed expenditures (i.e. additional security, school programs, and teachers’ wages, etc.) which can go far in helping student and school development and improvement. Some may wonder, wouldn’t it also help charter schools? However, the tax could cause charter schools – which are sometimes the only alternatives for students and parents whose zoned schools either fail students or are not safe mentally or physically for students – to close, and those that remain will be forced to struggle to get students while traditional schools continue on.

What choice do we have?

“Unfortunately the changes in the world have been brought to our door step,” Palm Beach School board member Karen Brill said. “We have no choice. We need our village, our tax payers, to help.”

Hailey Lazar • Nov 4, 2018 at 1:10 PM

Sally, you did a phenomenal job on this article. It is well written, and keep up the good work!

Wayne A Brown • Nov 4, 2018 at 12:14 PM

Very informative article, the writer unpacks the elements of the referendum and reveals it’s unfair treatment of Florida students and parents opting to avail themselves of an alternative to the traditional public schools.